We are pleased to privately offer a unique investment opportunity, located in one of the top rental markets of Dallas/Fort Worth, Texas. This asset has a solid track record of cash flow, and we are confident that it will provide our partners with excellent returns. We look forward to having you as a partner in this venture.

We are pleased to privately offer a unique investment opportunity, located in one of the top rental markets of Dallas/Fort Worth, Texas. This asset has a solid track record of cash flow, and we are confident that it will provide our partners with excellent returns. We look forward to having you as a partner in this venture.

ARIVA OPPORTUNITY

DETAILED BUSINESS PLAN

ARIVA OPPORTUNITY

DETAILED BUSINESS PLAN

VIDEO HIGHLIGHTS

VIDEO HIGHLIGHTS

THE INVESTMENT OPPORTUNITY

THE INVESTMENT OPPORTUNITY

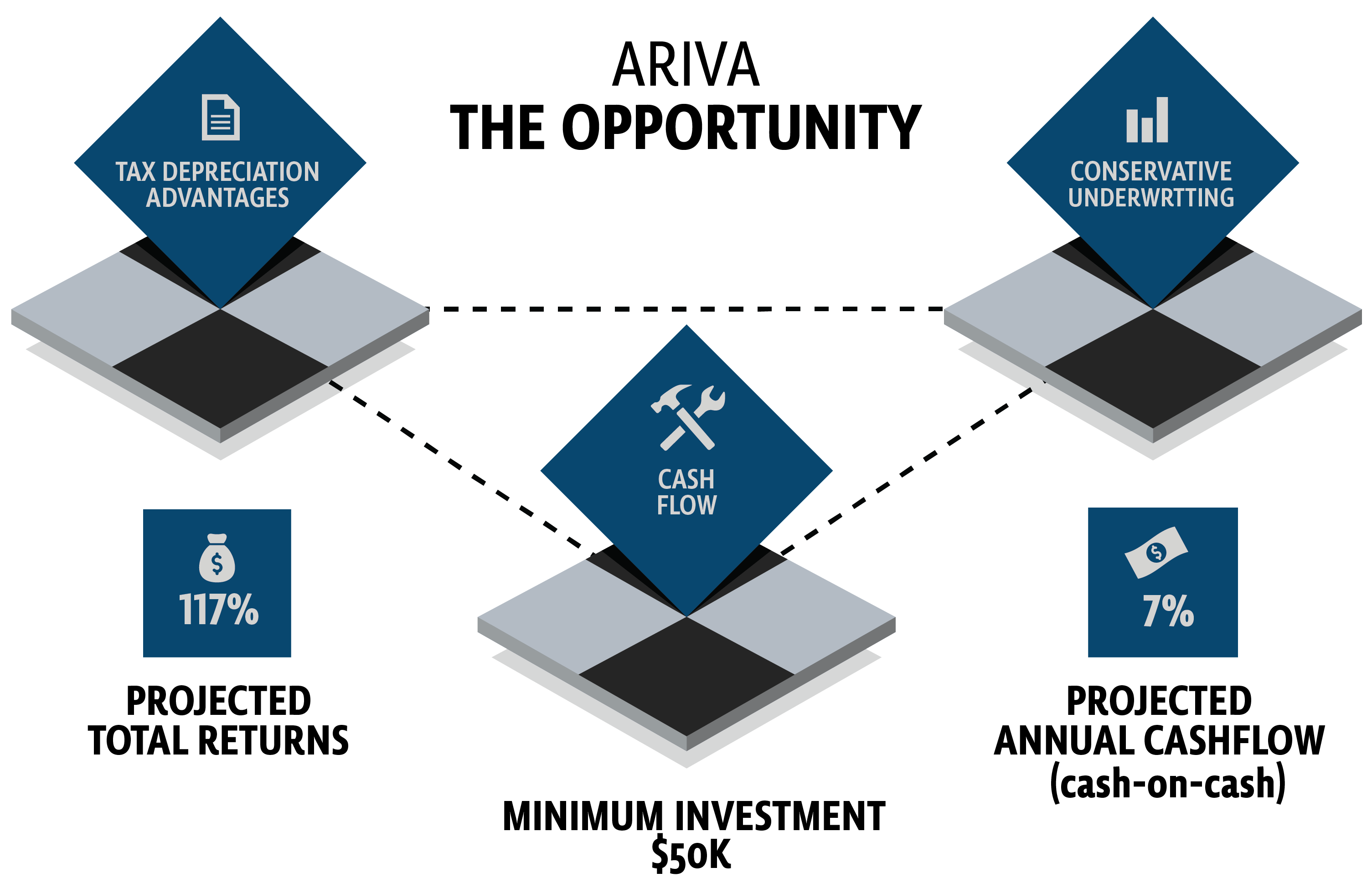

PROJECTED TOTAL RETURN

PROJECTED TOTAL RETURN

117%

117%

PROJECTED ANNUAL CASHFLOW

PROJECTED ANNUAL

CASHFLOW

7% preferred

7% preferred

PROJECTED EQUITY MULTIPLE

PROJECTED EQUITY MULTIPLE

2.17X

2.17X

PROJECTED IRR

PROJECTED IRR

17.8%

17.8%

ProjecteD Average

Annualized Return

ProjecteD Average Annualized Return

23.4%

23.4%

BONUS DEPRECIATION

BONUS DEPRECIATION

107%

107%

506(c) Offering

506(c) Offering

THE PROPERTY

THE PROPERTY

Ariva is a 176 unit, individually metered community located in Fort Worth, Texas on Woodway Drive just north of Alta Mesa and west of Hulen Street, both of which are major thoroughfares boasting substantial economic activity. Located near several schools and major hubs such as Harris Hospital, Chisholm Trail Parkway, and Hulen Mall, this location is incredibly well positioned for continued growth for many years to come.

Previous ownership invested $1.8M capex in an exterior “facelift” of the property, giving it a modern vibe that stands out from the rest of the comps. Current rents are $168 under market, with 4 of our top comps having recently traded or under contract, so we know rents are on their way up! Our value-add opportunity is to upgrade the interiors to match the exterior, develop additional resident amenities, bring rents up to market, and charge for desired amenities proven in the submarket.

Ariva is a 176 unit, individually metered community located in Fort Worth, Texas on Woodway Drive just north of Alta Mesa and west of Hulen Street, both of which are major thoroughfares boasting substantial economic activity. Located near several schools and major hubs such as Harris Hospital, Chisholm Trail Parkway, and Hulen Mall, this location is incredibly well positioned for continued growth for many years to come.

Previous ownership invested $1.8M capex in an exterior “facelift” of the property, giving it a modern vibe that stands out from the rest of the competition. Current rents are $168 under market, with 4 of our top comps having recently traded or under contract, so we know rents are on their way up! Our value-add opportunity is to upgrade the interiors to match the exterior, develop additional resident amenities, bring rents up to market, and charge for desired amenities already proven in the submarket.

HIGHLIGHTS

HIGHLIGHTS

Property

Property

176 Units Class B multifamily property in Southwest Fort Worth

Built 1979 consisting of 18 two-story buildings

Pitched roofs, with individual HVAC & electric

99% Physical occupancy

176 Units Class B multifamily property in Southwest Fort Worth

Built 1979 consisting of 18 two-story buildings

Pitched roofs, with individual HVAC & electric

99% Physical occupancy

Attractive Location

Attractive Location

Prime Location 14 minutes to Downtown Fort Worth

Proximity to Major Employers: Lockheed Martin, Southside Medical District, Texas Christian University (TCU), and Hulen Mall (government/defense, healthcare, university, retail)

Proximity to Schools: Across the street from Southwest High School, within 0.6 miles of Woodway Elementary and Wedgewood Middle School

Massive industrial presence along I-30/I-20 Corridor, Waterside, and Clearfork minutes away all under development, driving job and population growth

$63,000+ Median Household Income within 1-mile radius

“Much better to rent than buy”: Median home sales within a 0.5-mile radius are $350k (2022 Q1), indicating an entry barrier for single-family home purchases within the next 5+ years

Prime Location 14 minutes to Downtown Fort Worth

Proximity to Major Employers: Lockheed Martin, Southside Medical District, Texas Christian University (TCU), and Hulen Mall (government/defense, healthcare, university, retail)

Proximity to Schools: Across the street from Southwest High School, within 0.6 miles of Woodway Elementary and Wedgewood Middle School

Massive industrial presence along I-30/I-20 Corridor, Waterside, and Clearfork minutes away all under development, driving job and population growth

$63,000+ Median Household Income within 1-mile radius

“Much better to rent than buy”: Median home sales within a 0.5-mile radius are $350k (2022 Q1), indicating an entry barrier for single-family home purchases within the next 5+ years

Amenities

Amenities

Technology Package: Internet & Cable

Controlled Access/Gated Community

Covered Parking: 263 carports with no current premiums

Private Patios on all units

Swimming Pool for Residents

Community Center/Clubhouse

BBQ/Picnic area

Technology Package: Internet & Cable

Controlled Access/Gated Community

Covered Parking: 263 carports with no current premiums

Private Patios on all units

Swimming Pool for Residents

Community Center/Clubhouse

BBQ/Picnic area

Value-Add Acquisition

Value-Add Acquisition

Proven upgrade plan with average $168+ rent bumps

100 Classic & Partial Units for Renovation

Playground, Dog Park, & Fitness Center Development

Reserved Covered Parking Premiums Day 1! (263 covered and 49 open spaces with no current premiums in place)

Washer/Dryer machine rent, extended patios, and other income realization

$2.2M Capex budget

Proven upgrade plan with average $168+ rent bumps

100 Classic & Partial Units for Renovation

Playground, Dog Park, & Fitness Center Development

Reserved Covered Parking Premiums Day 1! (263 covered and 49 open spaces with no current premiums in place)

Washer/Dryer machine rent, extended patios, and other income realization

$2.2M Capex budget

Conservative Underwriting

Conservative Underwriting

Pro Forma rents under comps which have recently sold or under contract, so rents will go up! We underwrote below them, so anticipate tremendous upside!

15% rent increase in year 1 based on market comps, not taking into account 10% organic submarket rent growth (more upside!)

Floating bridge debt at 75% loan-to-cost and 100% capex funded (more leverage!)

1% prepayment penalty, allowing for flexible exit

Exit cap is 150 bps above purchase cap (most underwrite at 100 bps over)

$23.9M Purchase Price, with $9M Capital Raise

Price/Unit: $136k/unit. Property appraised at $138k/unit*.

One of our comps recently sold for $142/unit, and sponsors have a property under contract for sale at $177/unit in Dallas/Fort Worth area

Pro Forma rents under comps which have recently sold or under contract, so rents will go up! We underwrote below them, so anticipate tremendous upside!

15% rent increase in year 1 based on market comps, not taking into account 10% organic submarket rent growth (more upside!)

Floating bridge debt at 75% loan-to-cost and 100% capex funded (more leverage!)

1% prepayment penalty, allowing for flexible exit

Exit cap is 150 bps above purchase cap (most underwrite at 100 bps over)

$23.9M Purchase Price, with $9M Capital Raise

Price/Unit: $136k/unit. Property appraised at $138k/unit*.

One of our comps recently sold for $142k/unit, and sponsors have a property under contract for sale at $177k/unit in Dallas/Fort Worth area

*Values will be reflected in final appraisal.

*Values will be reflected in final appraisal.

THE SPONSOR TEAM

THE SPONSOR TEAM

EXPERIENCED SPONSORSHIP TEAM

EXPERIENCED SPONSORSHIP TEAM

Solidified sponsor team with extensive experience and knowledge working together on a long term basis

Combined 15,000+ multifamily units and successful syndication of over 2400+ units across 19 properties as deal sponsors

Thirteen (13) deals full cycle (deals exited or sale pending) with returns exceeding original pro-forma projections. Current average annualized return of 28% and average IRR of 25%.

Previous co-sponsored deal achieved 10.86% annual cashflow, 46% over projected 7.45% annual cashflow in first year of hold

Hands on "boots on the ground" asset management team local to DFW

Vertically-integrated asset management and operations with in-house construction arm to mitigate rising labor and supply chain costs. In-house landscaping arm to increase exterior curb appeal and retain that "cared for" touch. Proven method across 3 properties in current DFW portfolio.

All sponsors are members of the Brad Sumrok Apartment Investor Mastery Program. Neander is also the Marketing Director of Sumrok Core Team, and Tariq is also a Sumrok Coach, where he provides mentorship on multifamily acquisitions.

Solidified sponsor team with extensive experience and knowledge working together on a long term basis

Combined 15,000+ multifamily units and successful syndication of over 2400+ units across 19 properties as deal sponsors

Thirteen (13) deals full cycle (deals exited or sale pending) with returns exceeding original pro-forma projections. Current average annualized return of 28% and average IRR of 25%.

Previous co-sponsored deal achieved 10.86% annual cashflow, 46% over projected 7.45% annual cashflow in first year of hold

Hands on "boots on the ground" asset management team local to DFW

Vertically-integrated asset management and operations with in-house construction arm to mitigate rising labor and supply chain costs. In-house landscaping arm to increase exterior curb appeal and retain that "cared for" touch. Proven method across 3 properties in current DFW portfolio.

All sponsors are members of the Brad Sumrok Apartment Investor Mastery Program. Neander is also the Marketing Director of Sumrok Core Team, and Tariq is also a Sumrok Coach, where he provides mentorship on multifamily acquisitions.

DO YOU WANT TO FOLLOW ALONG?

Download the Investor Package PDF

DO YOU WANT TO FOLLOW ALONG?

Download the Investor Package PDF

If you still have questions or concerns, what better way to work through them than with a one-on-one call with one of us?

We are available to you to explain things further, answer your final questions, and help guide you through the next steps.

If you still have questions or concerns, what better way to work through them than with a one-on-one call with one of us?

We are available to you to explain things further, answer your final questions, and help guide you through the next steps.

DISCLAIMER NOTICE

This Business Plan contains privileged and confidential information and unauthorized use of this information in any manner is strictly prohibited. If you are not the intended recipient, please notify the sender immediately. Without prior permission from Ariva Apts LLC, no person accepting this document shall release or reproduce (in whole or in part) this document, discuss any information contained herein, make representations or use such information for any purpose other than to evaluate the company’s business plans as provided herein. By accepting this document, the recipient agrees to keep confidential all information contained herein or made available in connection with any further investigation. Upon request, the recipient will promptly return to the company all materials received from the Sponsors and their representatives (including this document) without retaining copies thereof.

This Business Plan is for informational purposes and not intended to be a general solicitation or a securities offering of any kind. Prior to making any decision to contribute capital, all investors must review and execute all private offering documents.

Potential investors and other readers are cautioned that these forward looking statements are predictions only based on current information, assumptions and expectations that are inherently subject to risks and uncertainties that could cause future events or results to differ materially from those set forth or implied by such forward looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. These forward-looking statements are only made as of the date of this Business Plan and Sponsors undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

The information contained herein is from sources believed to be reliable, however no representation by Sponsors, either expressed or implied, is made as to the accuracy of any information on this property and all investors should conduct their own research to determine the accuracy of any statements made. An investment in Ariva Apts LLC will be a speculative investment and subject to significant risks and therefore investors are encouraged to consult with their personal legal and tax advisors. Neither the Sponsors, nor their representatives, officers, employees, affiliates, sub-contractor or vendors provide tax, legal or investment advice. Nothing in this document is intended to be or should be construed as such advice.

DISCLAIMER NOTICE

This Business Plan contains privileged and confidential information and unauthorized use of this information in any manner is strictly prohibited. If you are not the intended recipient, please notify the sender immediately. Without prior permission from Ariva Apts LLC, no person accepting this document shall release or reproduce (in whole or in part) this document, discuss any information contained herein, make representations or use such information for any purpose other than to evaluate the company’s business plans as provided herein. By accepting this document, the recipient agrees to keep confidential all information contained herein or made available in connection with any further investigation. Upon request, the recipient will promptly return to the company all materials received from the Sponsors and their representatives (including this document) without retaining copies thereof.

This Business Plan is for informational purposes and not intended to be a general solicitation or a securities offering of any kind. Prior to making any decision to contribute capital, all investors must review and execute all private offering documents.

Potential investors and other readers are cautioned that these forward looking statements are predictions only based on current information, assumptions and expectations that are inherently subject to risks and uncertainties that could cause future events or results to differ materially from those set forth or implied by such forward looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. These forward-looking statements are only made as of the date of this Business Plan and Sponsors undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

The information contained herein is from sources believed to be reliable, however no representation by Sponsors, either expressed or implied, is made as to the accuracy of any information on this property and all investors should conduct their own research to determine the accuracy of any statements made. An investment in Ariva Apts LLC will be a speculative investment and subject to significant risks and therefore investors are encouraged to consult with their personal legal and tax advisors. Neither the Sponsors, nor their representatives, officers, employees, affiliates, sub-contractor or vendors provide tax, legal or investment advice. Nothing in this document is intended to be or should be construed as such advice.

Multifamily Empire LLC ©. All rights reserved.

3044 Old Denton Rd Ste 111-222, Carrollton, TX 75007

Multifamily Empire LLC ©. All rights reserved.

3044 Old Denton Rd Ste 111-222, Carrollton, TX 75007